The creation of the PPK programme is the result of Goverment cooperation:

- Polish Development Fund

- Employers' organisations

- Unions

Employee Capital Plans is a universal and voluntary long-term savings system for employees, created and co-financed by employers and the Goverment.

Since the beginning of 2019, a specially created information portal www.mojeppk.pl has been in operation, which conducts a wide information campaign, publishing numerous questions and answers and posting downloadable information materials for employers and employees, also in foreign languages. It also publishes offers of financial institutions offering ppk management. In the future, employees will be able to use it to check the value of their savings in PPK.

Key benefits of the PPK program

PPK means greater financial security for empoyees.

The public pension system guarantees a retirement for working people, but an ageing population will prevent these benefits from going high. The problem of low pensions is particularly true for people who are currently under 40 years of age and have not raised initial capital in zus. PPK savings can complement the pension – the accumulated capital in the employee PPK account will make future pensioners wealthier.

Saving in PPK is voluntary and very profitable.

If we save ourselves, we only have as much as we have saved. It is much more advantageous in PPK. In simple terms, almost every penny put aside by the employee is paid monthly by the employer, and the state adds a welcome payment and an annual surcharge. In this way, the employee putting capital in PPK account accumulates a higher amount than if he had saved himself and his savings are professionally invested.

You can opt out of participating in PPK.

Both at the stage of creating the programme in the workplace and at any time in the future, participation in the PPK is voluntary. The employee's account in ppk is fully private and the funds raised are subject to inheritance.

Social research shows that nearly 80% of Poles would like to have savings, but only a dozen percent save in the long term.

Of course, many families today have too low wages to save. Unfortunately, Poles usually save in the short term and less efficiently than citizens in developed countries. This is evidenced by the excessive share of current deposits (low- or interest-free) in banks, and not enough funds are invested.

Participation in the PPK program is simple and requires virtually no additional activities, while at the same time enabling the effective management of your home finances. Every employee saving in PPK - through specialized and low-fee funds - becomes an investor on the Polish market and international markets.

PPK is a programme of solidarity and social responsibility of employers and raising the standard of the Polish labour market.

Each employer will be required to create a PPK for employees and pay at least 1.5% of their salary to their bills in the program. The administrative obligations of employers in setting up PPK have been simplified as much as possible.

Employers' involvement in the PPK programme will be appreciated as their contribution to the long-term financial security of employees. Raising labour market standards will increase the attractiveness of working life and increase the motivation of workers – which will benefit employers.

Benefits for workers and the economy

PPK is an opportunity to increase the growth potential and stability of the economy for the benefit of rising wages and corporate profits. In Poland, there is still a lack of local capital, and the level of wealth and savings of Polish households is among the lowest among the countries of the European Union. A small resource of capital is a low investment and a threat to the potential for economic Polish, including maintaining the pace of wage growth and the competitiveness of Polish companies.

PPK can change a number of negative trends. The savings accumulated every year under the PPK should give a new impetus to development, strengthen the local capital market, reduce foreign debt, increase the level of wealth of Poles, accelerate investment and economic growth – all for the benefit of employees and employers.

Simple rules and private savings

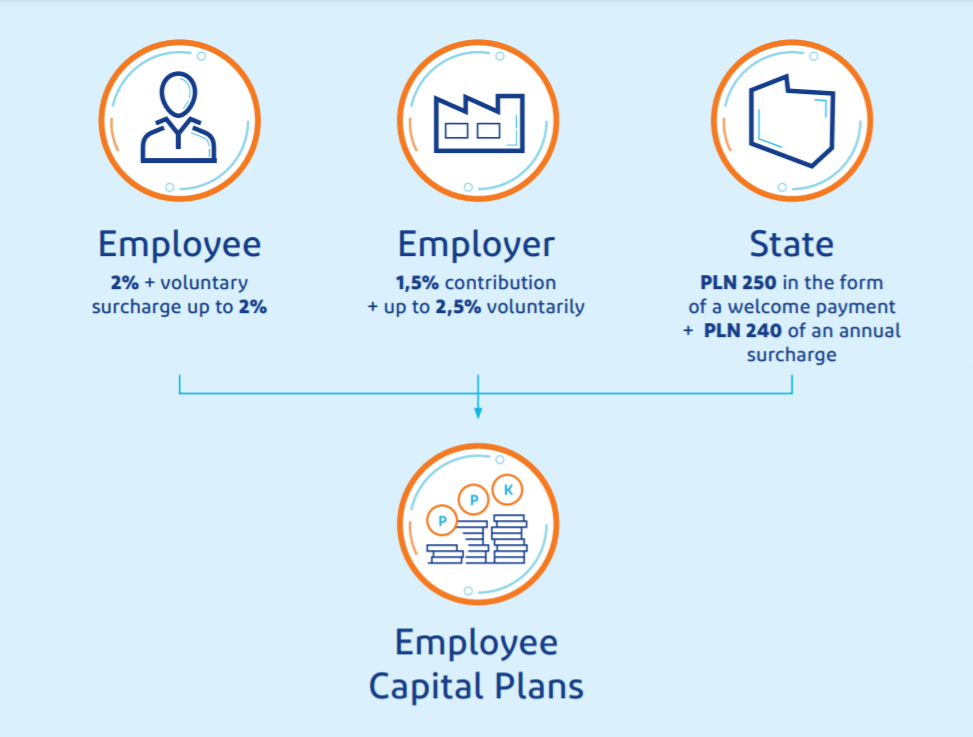

Contributions to PPK accounts will come from three sources: employer, employee and state. In the case of an employee and an employer, the amount of contributions will be calculated as a percentage of the amount of the salary. State contributions are amounts independent of the employee's income. Anyone who decides to save in PPK will receive a one-time £250 welcome deposit. Then, every year, after meeting certain conditions, the Labour Fund will fund the employee's account with the amount of PLN 240.

An employer employing at least one person for whom pension contributions are paid to the ZUS under the titles listed in the Act on PPK will select the financial institution managing the employee's PPK and open through it a personal PPK account in which his savings will be collected.

An automatic registration of persons aged between 18 and 54 will apply to the PPK (a staff member who is over 55 and under 70 years of age applies to join the programme himself). The employee will have the opportunity to withdraw from participation in the PPK by signing a declaration of non-payment to ppk. PPK is a capital system that is not part of the pension system, so the savings in the employee's account are private, can be paid out at any time and are inherited.

The ppk saver will be free to use the accumulated funds in his/her account after the age of 60 – regardless of the status of the professional activity. It is worth remembering, however, that the age of 60 does not automatically mean the end of saving in PPK (a 60-year-old PPK participant can still actively save in this program).

However, if, after the age of 60, he decides to withdraw the accumulated funds, he will be able to decide for himself how he intends to use them.

So maybe:

- use the default form of withdrawal: withdraw 25% of the funds once and pay the rest in at least 120 monthly instalments (payment in this form will be exempt from capital gains tax, this is to encourage employees to withdraw the accumulated funds for a longer period of retirement). The employee may also withdraw the remaining funds (or all of the accumulated savings) in any number of instalments. Please note that reducing the payout period to less than 10 years (120 installments) will result in the payment of the capital gains tax due;

- make a transfer payment:

- for a policy with the right to a periodic or life benefit,

- to an account for a term savings deposit in accordance with the conditions laid down in the Act;

- payment of funds in the form of a matrimonial benefit (payments from one joint matrimonial account).

The savings collected by the PPK participant are his private property. Therefore, despite the target allocation of these funds for withdrawal after the age of 60, the PPK participant can use them at any time by making a refund (without having to state a reason). In such a situation, the payment will be reduced by the state subsidies (welcome payment and annual payments), 30% of the funds from the employer's contributions (they will go to the employee's individual account in the ZUS as his pension contribution) and 19% capital gains tax on the profit earned by the rest of the funds, derived from the employer's contributions and employee contributions.

In exceptional cases, the funds raised can be paid out in advance without deductions: up to 25% of the funds – in the event of serious illness of the PPK participant or his or her loved ones (spouse, child), up to 100% of the funds – to cover the own contribution when taking out a loan for the purchase of an apartment or the construction of a house.

More information about Employee Capital Plans can be found on the PPK Portal at www.mojeppk.pl.

The role of the Polish Development Fund

You can read more about the role of the Polish Development Fund on the corporate website.